Our Latest

News from A&Z Accounting Services

What is the best way for small businesses to keep accounting records

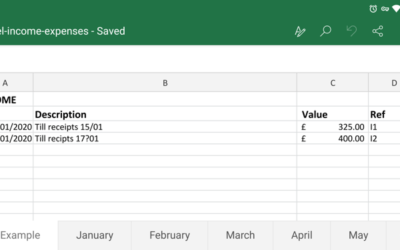

We all like low accounting fees and accurate financial records are one way you can reduce your accounting bill. Good quality records are far easier for your accountant to work with thereby reducing the time it takes to process your tax return. The means of achieving...

Book-keeping Advice

The maintenance of an accurate bookkeeping system is important for all businesses.

HMRC and Business Link confirm that no matter what the size or type of business, the record keeping should include these items.

Personal Tax Returns

HMRC require tax returns to be submitted by certain deadlines to avoid penalties. From the 6 April 2011, HMRC have changed the way penalties are calculated meaning that even if you are one day late submitting your tax return, you will be fined £100 whether you have paid your taxes on time or not.

Management Accounts

Management accounts are a useful tool used by you, the business owner to make timely decisions with regards to your business requirements.

Sage Systems

You will save money on your accountancy bill if you use Sage”. This is true if you are using sage to record all of your transactions and you complete the monthly processes.

Additional REsources

A Few of our most popular posts you may have missed

What is the best way for small businesses to keep accounting records

We all like low accounting fees and accurate financial records are one way you can reduce your accounting bill. Good quality records are far easier for your accountant to work with thereby reducing the time it takes to process your tax return. The means of achieving...

Personal Tax Returns

HMRC require tax returns to be submitted by certain deadlines to avoid penalties. From the 6 April 2011, HMRC have changed the way penalties are calculated meaning that even if you are one day late submitting your tax return, you will be fined £100 whether you have paid your taxes on time or not.

Sage Systems

You will save money on your accountancy bill if you use Sage”. This is true if you are using sage to record all of your transactions and you complete the monthly processes.

Contact Us

We always welcome contact from our customers or others who are interested in our services. Please contact us using the form or the details below.